Crypto tax calculator usa

NFT and Crypto Taxes for Investors and Tax. Long-term gains are applied to crypto-assets that have been held for 366.

Us Tax Rates For Crypto Bitcoin 2022 Koinly

Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income.

. Your average tax rate is 1198 and your marginal tax rate is 22. Here is a list of the best no-KYC crypto exchanges that will let you carry out transactions without having to compromise your personal details. You can not only generate your crypto tax reports but also track your asset portfolio.

Donate crypto to a tax-exempt organization. 1400 for each child dependent under the age of 17. But taking a look at your portfolio before filing your crypto tax report can help you choose a method that lowers your liability as much as possible.

You can export all the required forms in under 20 minutes using our platform. ZenLedger is the best crypto tax software. Led by our in-house Heads of Tax we produce practical guides and resources to help tax professionals steer their clients in the right direction.

Learn About Our Crypto Tax Report Pricing. Assess Your Portfolio by December. Though our articles are for informational purposes only they are written in accordance with the latest guidelines from tax agencies around the world and reviewed by certified tax professionals before publication.

Use Crypto Tax Calculator. Capital Gains vs. On July 27 the Federal Reserve announced another big rate hike raising the federal funds rate by 75 basis points bps to a range of 225 to 25.

Enter your income and other filing details to find out your tax burden for the year. 2021 capital gains tax calculator. Use our income tax calculator to estimate how much youll owe in taxes.

Your average tax rate is 1198 and your marginal tax rate is 22. Unfortunately you have to choose one cost basis method and be consistent. Tax on crypto mining USA.

Tax-Loss Harvesting With A Crypto Tax Calculator. 2800 for qualifying couples who file a joint tax return. This marginal tax rate means that your.

Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. Support For All Exchanges NFTs DeFi and 10000 Cryptocurrencies. If you sell or spend your crypto at a loss you dont.

Cryptocurrency Tax Calculator. Koinly can generate the right crypto tax reports for you. Your average tax rate is 1198 and your marginal tax rate is 22.

Instant Crypto Tax Forms. Integrates major exchanges wallets and chains. Heres some good news for crypto taxes.

We also offer specialised tax reports for countries like USA Canada Australia UK Germany Norway Denmark Sweden. Our content is designed to educate the 300000 crypto investors who use the CoinLedger platform. If you make 70000 a year living in the region of Georgia USA you will be taxed 11993.

This move follows a 75 basis-point hike in. Download your tax documents. In some instances like with lower value coins its definitely worth using a crypto mining calculator to ensure its worth your while to mine if you have high electricity costs.

Crypto Tax Guides Webinars Affiliate Program Press Media How Is Cryptocurrency Taxed Crypto Taxes 101 Bitcoin Taxes Guide Crypto Calculator Crypto. Powerful Accurate Tax Reports. And not just that one can easily contact customer support to help with any questions.

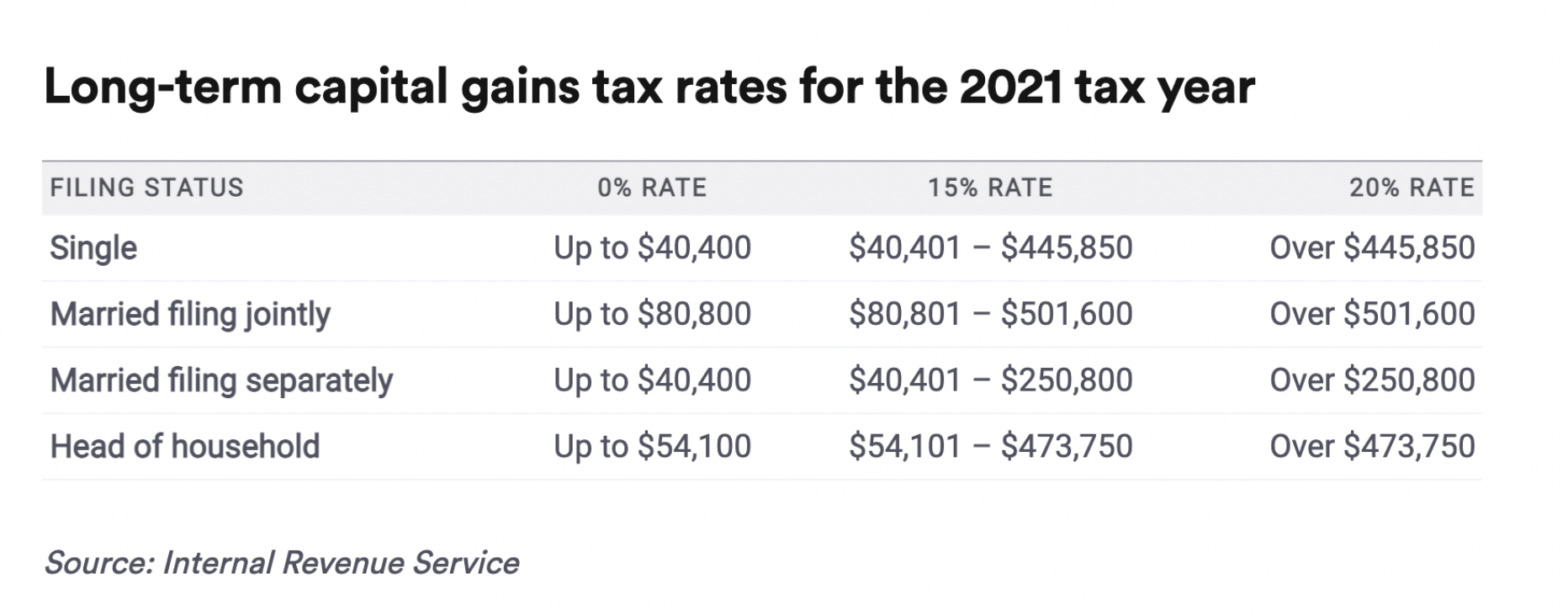

Long-term and short-term gains. The rates of crypto taxes depend on the holding period of the asset and can be categorized into two groups. Calculate Crypto Taxes in 20 Minutes.

ZenLedger currently supports over 400 exchanges 7000 token types 20 DeFi protocols ERC-721 NFTs and all wallets. If you make 70000 a year living in the region of Arizona USA you will be taxed 10973. Get support and information when crypto tax rules change.

This marginal tax rate means that. Brian Harris tax attorney at Fogarty Mueller Harris PLLC in Tampa Florida says buying and selling crypto creates some of the same tax consequences as more traditional assets such as real. You only owe taxes if you spend or sell it and realize a profit.

This marginal tax rate means that. We support all countries that use Average Cost FIFO LIFO HIFO etc for calculating gains. Coinpanda is a cryptocurrency tax calculator built to simplify and automate the process of calculating your taxes and filing your tax reports.

If you are filing in the US Koinly can generate filled-in IRS tax forms. Other rules for crypto taxes. Covers NFTs DeFi DEX trading.

Regardless of the scale youre mining at youll pay Income Tax on. However you may only. The IRS has taken a hard stance when it comes to crypto mining tax.

A company that helps businesses with crypto tax reporting. NerdWallet USA NerdWallet UK. Waiting for the last moment in April to choose a crypto tax strategy is quaint.

10 to 37 in 2022 depending on your federal income tax bracket. Visit Koinlys dedicated Accountant Hub for local tax guides and information on regulatory. Proud to be backed by.

Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains. Up to 1400 for qualifying individuals. Free version available for simple returns only.

Form 8949 Schedule D. In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year. Right now if Bitcoin is at.

Crypto tax can be confusing to say the least. If you make 70000 a year living in the region of Oregon USA you will be taxed 15088. Whether you are filing yourself using a tax software like TurboTax or working with an accountant.

Cryptocurrency Tax Calculator Forbes Advisor

Investments Young Woman Investor Buys Stocks On The Stock Exchange Stock Market From Home Generation Z Invests Cryptocurrency Trading Stock Market Budgeting

How To Calculate Crypto Taxes Koinly

How To Calculate Crypto Taxes Koinly

Crypto Tax Calculator Accointing Com

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Gs Medical Usa Announces Q2 Sales Results And Leadership Expansions Ortho Spine News Servicos De Contabilidade Planejamento De Negocios Contabilidade Financeira

Monthly Take Home Pay From A 100k Annual Salary Vivid Maps Map Salary Personal Financial Planning

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

What Are The Best Cryptocurrencies For Swing Trading In 2022 Swing Trading Day Trading Short Term Trading

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

How To Calculate Crypto Taxes Koinly

How I Turned A Landing Page Into A Luggage Storage Startup Starter Story Start Up Successful Business Owner Landing Page

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Calculate Your Crypto Taxes With Ease Koinly

The Sec Rejected Vaneck S Spot Bitcoin Etf Software Citing Investor Safety Securities And Exchange Commission Financial Instrument Investing

The Taxman Cometh Us Russian Investors Face New Calls To Pay Noticias Actualidad Noticias Unas Francesas